This credit is equal to 20 percent of up to $10,000 in eligible education expenses, or $2,000 total. The Lifetime Learning Credit is open to all students, even graduate students and those who are enrolled less than half-time. Taxpayers may also qualify for a refundable credit up to $1,000

#Us tax brackets 2020 plus

The credit is equal to the first $2,000 you spend per student plus 25 percent of the next $2,000 you spend, for a maximum credit of $2,500. The American Opportunity Tax Credit is restricted to undergraduates who are enrolled for at least one academic period for at least half-time a year. Your credit is the applicable percentage of these amounts. But these figures aren’t the amount of your credit. The child and dependent care tax credit is a percentage of your daycare expenses up to $3,000 for one dependent or $6,000 for two or more dependents. The medical expense deduction is 7.5% of qualified unreimbursed medical law expenses for 2020. The tax bill eliminates the tax penalty for not having health insurance after December 31, 2018. The tax bill eliminated the personal and dependency exemptions which were $4,050 in 2017. This is non-refundable tax credit of up to $500 per qualifying person. The phaseout also applies to the new $500 credit for other dependents.ĭependents who can’t be claimed for the Child Tax Credit may still qualify you for the Credit for Other Dependents. The beginning credit phaseout for the child tax credit increased in 2018 to $200,000 ($400,000 for joint filers). The refundable portion of the credit is limited to $1,400. The age cut-off remains at 17 (the child must be under 17 at the end of the year for taxpayers to claim the credit). Under the 2018 tax reform the credit is worth up to $2,000 per qualifying child. Increased Child Tax Credit and Income Ranges This new law now limits the deduction when it was previously unlimited (depending on your tax bracket). For tax years beginning after December 31,2017 and before January 1, 2026, a taxpayer may claim an itemized deduction of up to $10,000 ($5,000 for a married taxpayer filing a separate return) for taxes paid at the State and local level, including real and personal property, income, and/or sales taxes.

One change, in particular, has been the subject of much debate in Congress, the state and local income tax (SALT) deduction, which is now limited to $10,000. Much has changed with the passing of the Tax Cuts and Jobs Act-changes that will benefit some taxpayers and negatively impact others.

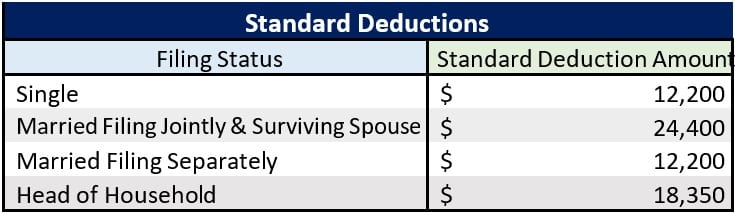

State, Local, and Property Taxes – Limited to $10K You may increase your standard deduction by $2,600 if both you and your spouse are blind. If you are Married Filing Jointly and you or your spouse is blind, you may increase your standard deduction by $1,300. If you are legally blind, you may increase your standard deduction by $1,650 if filing Single or Head of Household. If both you and your spouse are 65 or older, you may increase your standard deduction by $2,600. If you are Married Filing Jointly and you or your spouse is 65 or older, you may increase your standard deduction by $1,300. If you are age 65 or older, you may increase your standard deduction by $1,650 if you file Single or Head of Household. Under the new law, no exceptions are made to the standard deduction for the elderly or blind. The 2020 standard deduction is increased to $24,800 for married individuals filing a joint return $18,650 for head-of-household filers and $12,400 for all other taxpayers.

2020 Marginal Income Tax Rates and Brackets 2020 Marginal Tax Rate

0 kommentar(er)

0 kommentar(er)